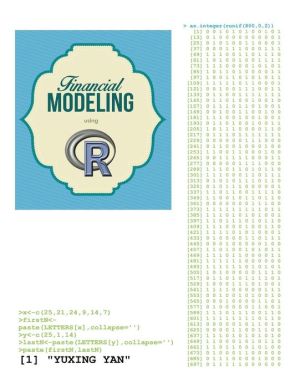

Financial Modeling using R book

Par hancock terry le mardi, novembre 22 2016, 02:57 - Lien permanent

Financial Modeling using R by Yuxing Yan

Financial Modeling using R Yuxing Yan ebook

Format: pdf

ISBN: 9781681875309

Page: 422

Publisher: Tate Publishing

Finance book entitled "Option Pricing and Estimation of Financial Models in R". Ang, CFA is the author of Analyzing Financial Data and Implementing Financial Models Using R. The design of this model was done using class modules inside of Excel. For volatility modeling, the standard GARCH(1,1) model can be estimated estimation of stochastic volatility using Markov Chain Monte Carlo. For a financial subsidiary in less than a day using R. Plotting Time Series in R using Yahoo Finance data. How to develop sophisticated spreadsheet models using R programming language. R/Finance 2015: Applied Finance with R. An R package to manage the quantitative financial modelling workflow. We present the theory and applications for generalized convolutions on the real line. Step by step, financial models are built with the associated R code Chap 3: Asset Pricing Model Bayesian modeling using WinBUGS. Analyzing Financial Data and Implementing Financial Models Using R (Springer Texts in Business and Economics) [Clifford Ang] on Amazon.com. Guy Yollin: Fundamental Factor Model DataBrowser using Tableau and R (pptx). R an open-source software combines well with Excel to offer a good balance of power in the context of building R/Excel financial spreadsheet models.

Download Financial Modeling using R for iphone, nook reader for free

Buy and read online Financial Modeling using R book

Financial Modeling using R ebook pdf zip djvu rar mobi epub